tax reduction strategies for high income earners australia

Tax Strategies For High Income Individuals How to reduce taxable income for high earners. You can currently claim up to 27500 as a tax.

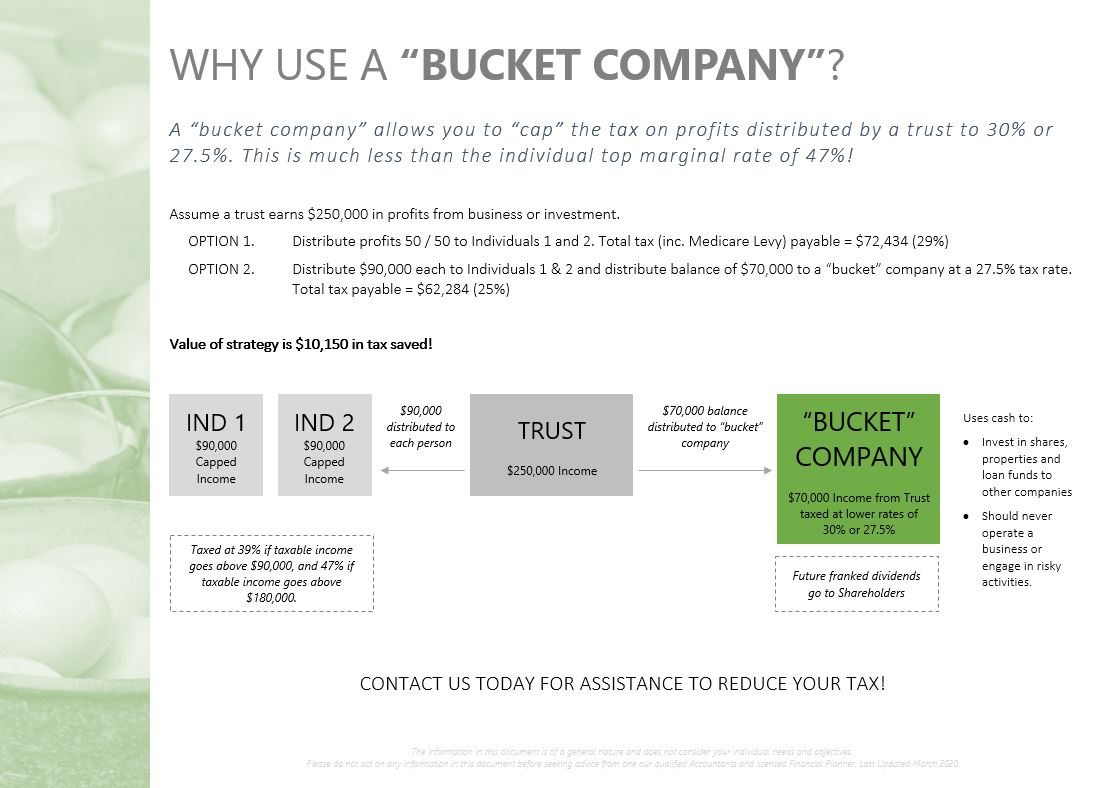

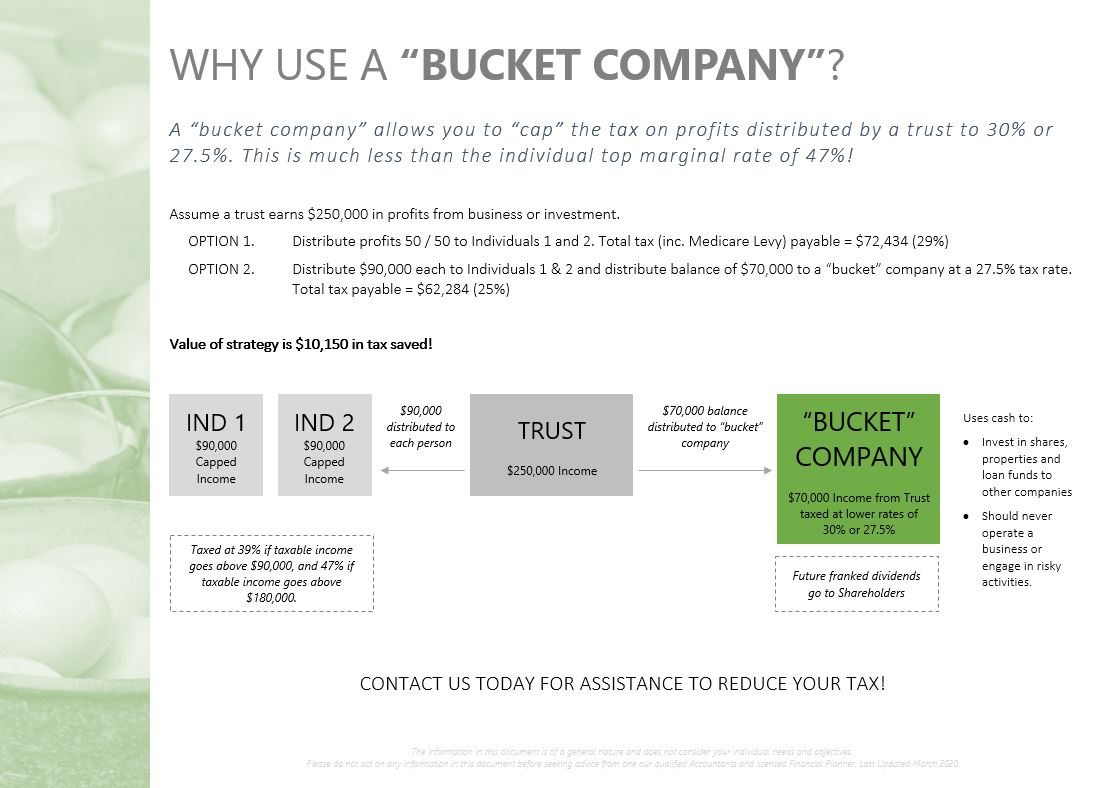

Using A Bucket Company To Save Tax 2021

There are plenty of opportunities for high-income earners to reduce their tax burden.

. Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. The extra 15 tax imposed under the Division 293 rules is applied because as a high-income earner your marginal tax rate without the 2 Medicare levy for income amounts over 180000 is 45 in 202122. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners.

Keep Accurate Tax and Financial Records. Estate and gift exemptions increasing equity exposure charitable donations health savings social security and Medicare buying municipal bonds tax loss harvesting and more. For those trying to learn how to save tax in Australia salary sacrificing is one way to do.

When you make a concessional contribution into your super account however you only pay a 15 tax rate. And given the extortionate rent rates here and median house price I think single. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia.

August 12 2014. The ATO is far more likely to ask a lot of questions about your tax. Tax reduction strategies for high income earners australia Thursday March 10 2022 Edit.

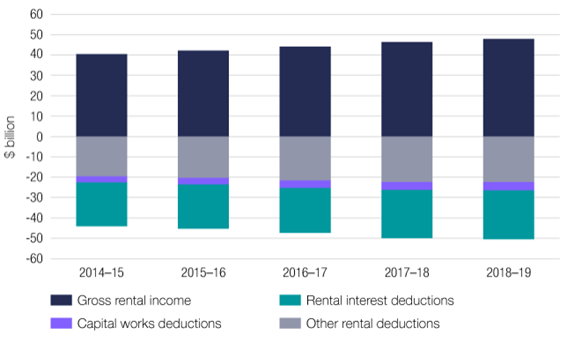

ATO allows individuals to reduce their tax on salary by claiming deductions on work-related expenses that were not reimbursed by the employer. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. While the taxman is targeting investors hiding assets overseas there are much less complicated ways to cut your tax bill.

Effective tax planning with a qualified accountanttax specialist can help you to do that. In many cases the tax savings can be tens of thousands even hundreds of thousands of dollars in a very short period of time. Exploring tax savings through depreciation superannuation SMSFs and capital gains tax reductions are just.

I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax. The federal income tax is designed to tax higher levels of income at higher tax rates. These penalties can range from fines to imprisonment for more.

High-income earners will gain two-fifths of the Coalitions tax cuts in 2020-21 rising to more than four-fifths in 2021-22 according to the Australia Institute. Tax reduction strategies. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA.

Specifically important numbers for 2022 include. User 552406 11075 posts. One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions.

The age for Required Minimum Distributions or RMDs was raised to 72 from 70-½ in 2020 although if you turned 70-½ in 2019 you still needed to start RMDs in 2020. Home australia high reduction strategies. This rate is lower than the personal income tax rate.

Keeping savings in a mortgage offset. Here are some of the most accessible tax reduction strategies that ATO allows. Many Australian Tax Videos Are Discuss The Same BORING Strategies.

The higher your tax bracket the higher the benefits are of tax savings. The maximum amount that can be contributed to superannuation as a concessional contribution is 25000 per financial. With the Medicare levy already legislated to increase from 15 to 2 from 1 July 2014 the rise in levies will effectively be 25 for.

This video gives a few suggestions on how to reduce taxable income. If you are a high-income earner it is sensible to implement tax minimisation strategies. In all honesty taking advantage of a donor-advised fund is probably one of the best strategies to reduce taxes for high income earners because it allows you to take current and future year contributions and deduct them all in the current year.

These retirement accounts use pre-tax money so you can deduct. Individuals with a taxable income of between 50k and 250k tax brackets gain the most from this strategy due to the super tax rate 15 versus your marginal tax rate. Tax reduction strategies for high income earners australia Tuesday March 1 2022 Edit.

Home australia reduction strategies tax. 15 Easy Ways to Reduce Your Taxable Income in Australia 1. Six tips for paying less tax.

Tax advice for high income earners. Specifically contribute to a traditional 401 or IRA. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to consider some planning strategies to lessen the impact.

Australia Current Situation In Control Strategies And Health System The Most Tax Efficient Company Structures To Reduce Tax Burdens Wealth Safe.

How To Pay Less Taxes For High Income Earners Wealth Safe

Tax Reform Welcome But More To Do Betashares

1 Key Policy Insights Oecd Economic Surveys Netherlands 2021 Oecd Ilibrary

How To Pay Less Taxes For High Income Earners Wealth Safe

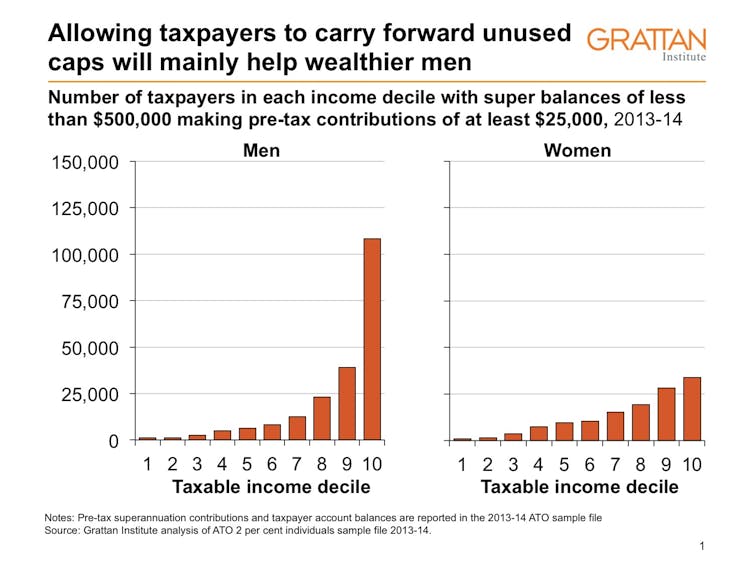

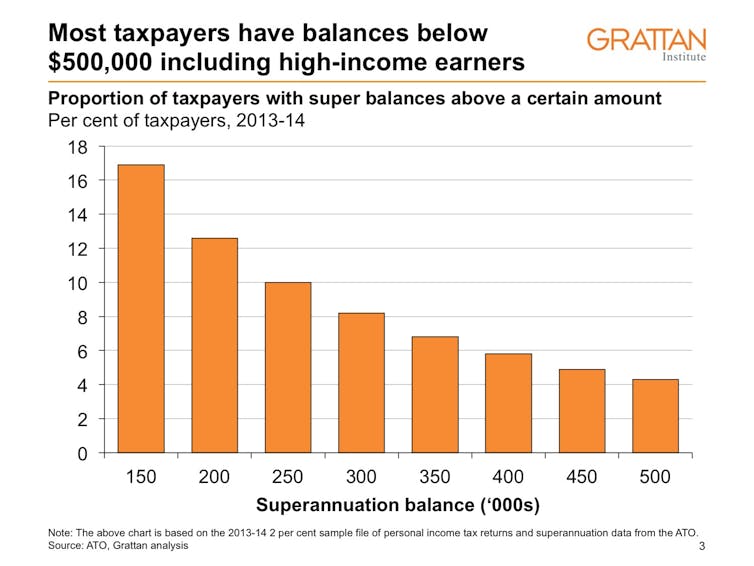

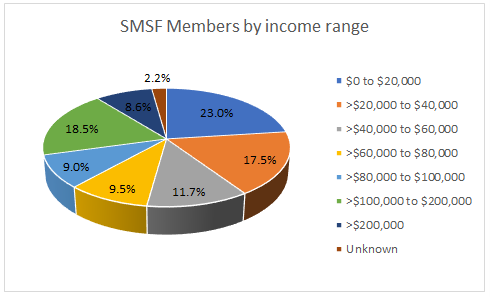

Super Contribution Cap Changes Could End Up Benefiting The Rich

1 Key Policy Insights Oecd Economic Surveys Netherlands 2021 Oecd Ilibrary

Tax Reform Welcome But More To Do Betashares

Super Contribution Cap Changes Could End Up Benefiting The Rich

1 Key Policy Insights Oecd Economic Surveys Netherlands 2021 Oecd Ilibrary

How To Pay Less Taxes For High Income Earners Wealth Safe

How To Pay Less Taxes For High Income Earners Wealth Safe

How To Pay Less Taxes For High Income Earners Wealth Safe

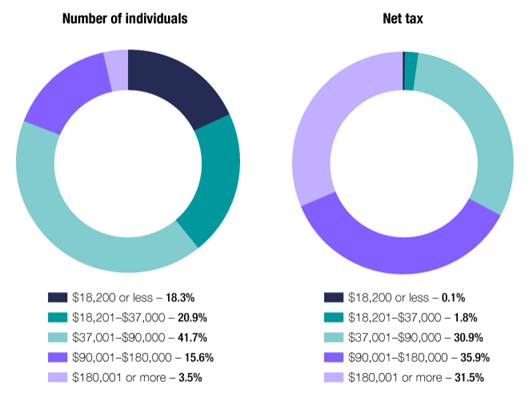

100 Aussies Five Charts On Who Earns Pays And Owns

Italy Toward A Growth Friendly Fiscal Reform In Imf Working Papers Volume 2018 Issue 059 2018

100 Aussies Five Charts On Who Earns Pays And Owns

How To Pay Less Taxes For High Income Earners Wealth Safe